This is a very valuable asset even if one cannot touch or see it. It denotes the firms capacity to earn a greater profit in the future based on its track record.

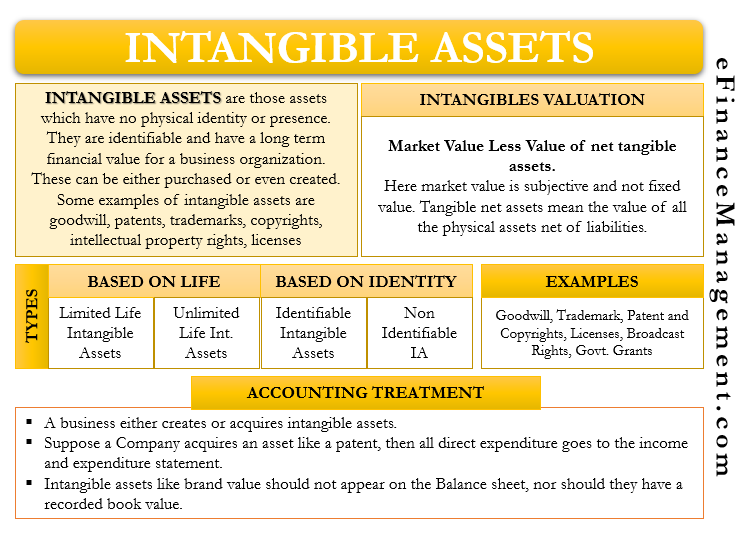

Intangible Assets Meaning Valuation Categories Example Accounting

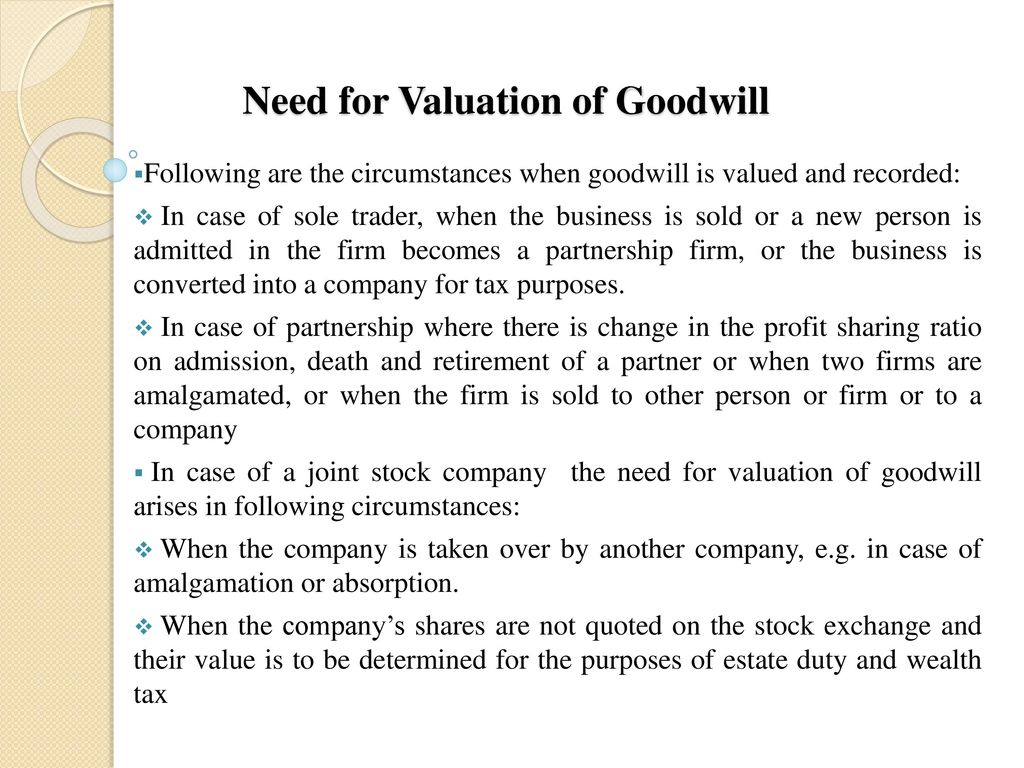

Need For Valuation Of Goodwill The need for valuation of goodwill arises in various circumstances.

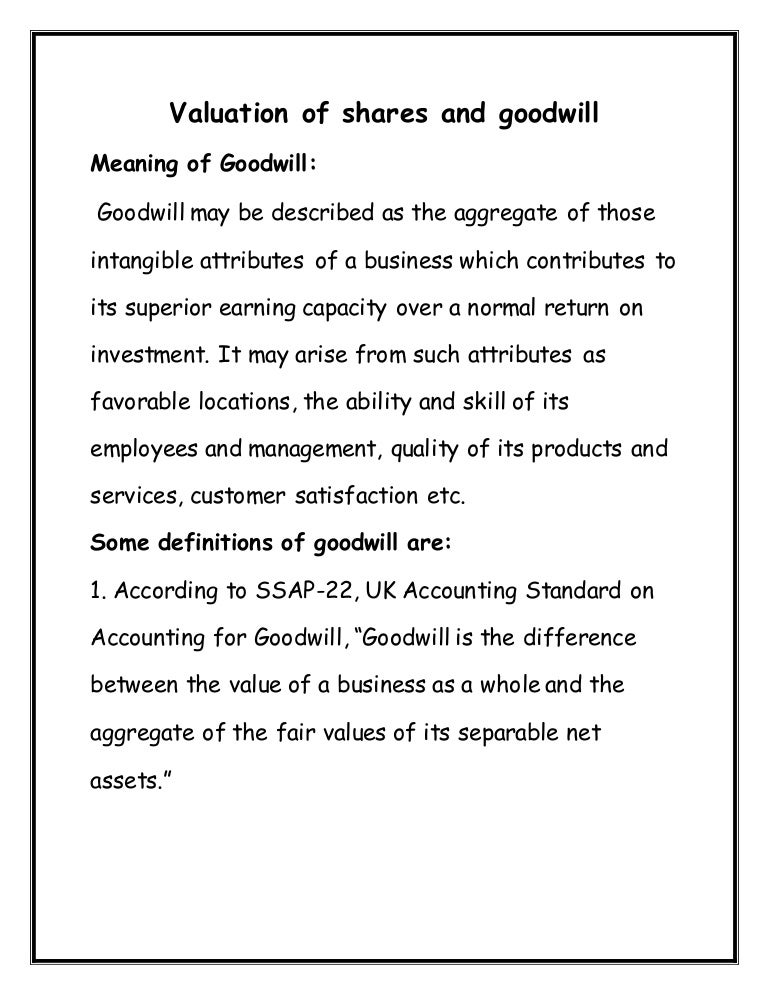

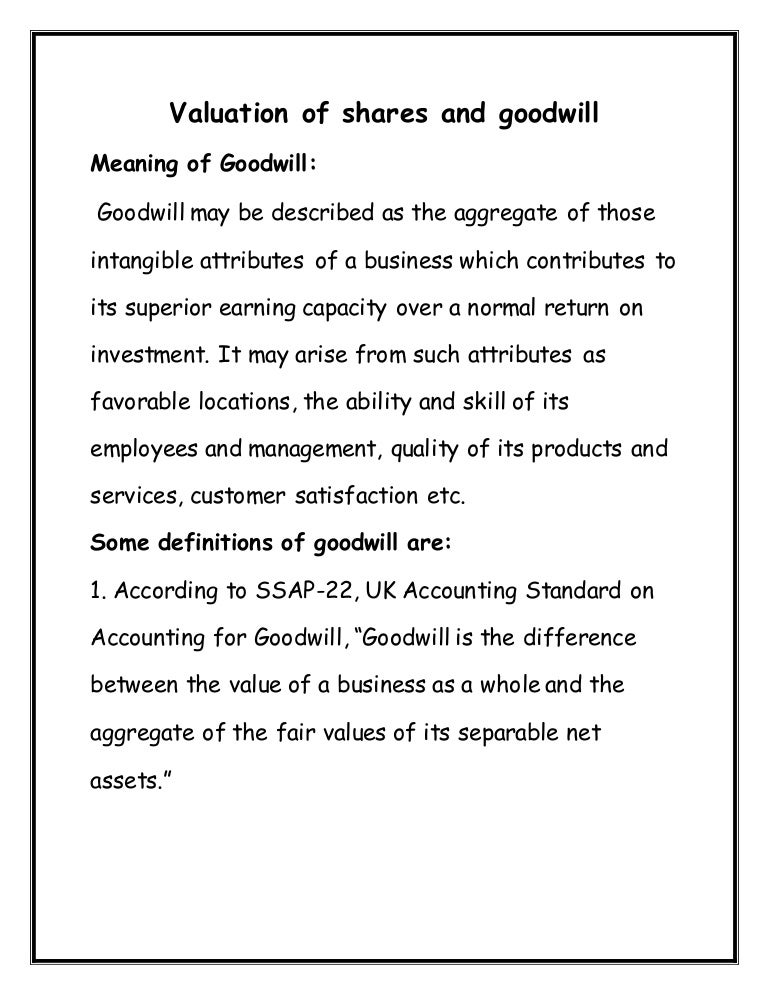

Concept And Meaning Of Goodwill And Need For Valuation Of. Therefore it can be stated that Goodwill is the value of the representative firm judged in respect of its earning capacity. NEED FOR VALUATION OF GOODWILL. The value of goodwill has no relation to the amount invested or the cost incurred to build it.

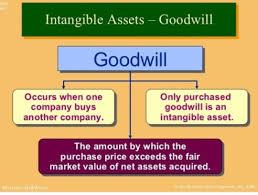

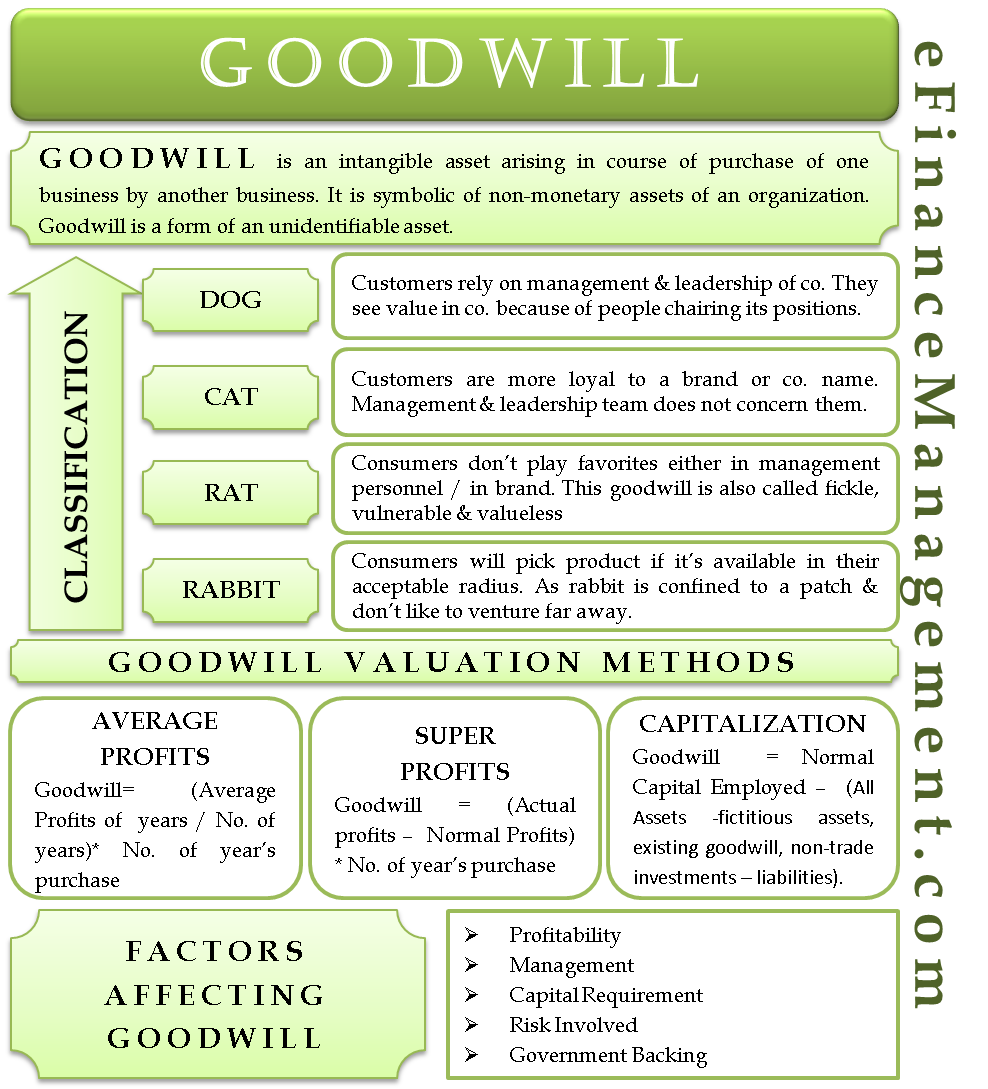

Therefore goodwill can be defined as an intangible asset of the business. Goodwill is an intangible asset that is associated with the purchase of one company by another. Some of the circumstances are as follow.

From the following information find out Goodwill a as per annuity method b as per 4 years purchase of super profit and c as per capitalisation of super profit method. Goodwill is the benefit and merit of good name and reputation. Here is a compilation of top eleven accounting problems on valuation of goodwill and shares with its relevant solutions.

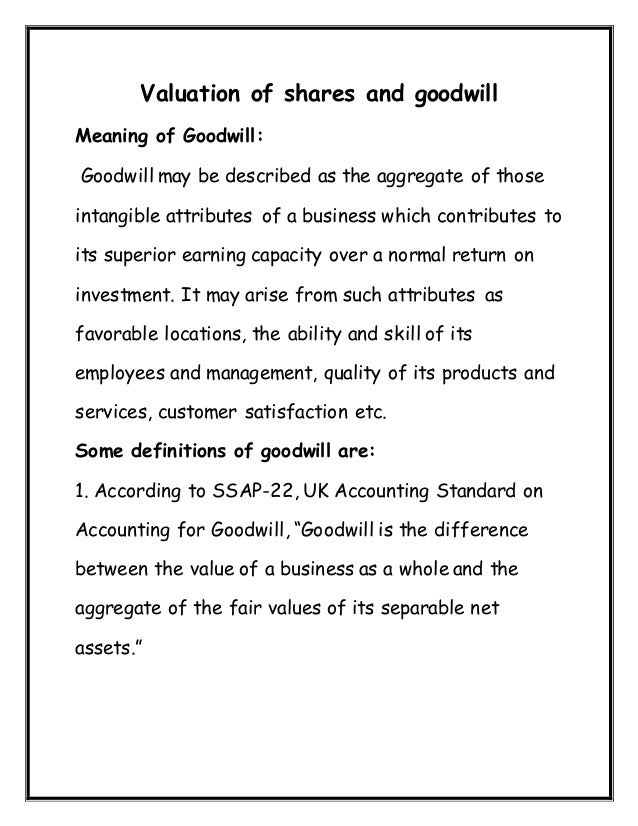

Goodwill in accounting is an intangible asset that arises when a buyer acquires an existing business. On the other hand it is valueless if the concern is a losing one. The value of an enterprises brand name solid consumer base functional consumer associations good employee associations and any patents or proprietary technology represent some instances of.

Where shares are hold jointly by the partners in a company and partnership firm dissolved it becomes necessary to value. The value of goodwill may fluctuate widely according to internal and external factors of the business. It is a valuable asset if the concern is profitable.

Specifically goodwill is recorded in a situation in which the purchase price is higher than the sum of the fair value of all visible solid assets and intangible assets purchased in the acquisition and the liabilities assumed in the process. Goodwill is an intangible real asset which cannot be seen or felt but exists in reality and can be bought and sold. In the case of sole trading concern goodwill is valued at the time of selling of business to take any person as a partner to convert sole trading concern into a company.

Goodwill is an intangible asset associated with the purchase of one company by another. It is subject to fluctuations. The asset is intangible but not fictitious.

Goodwill is nothing but the reputation of a partnership firm. The elements or factors that a company is paying extra for or that are represented as goodwill are things such as a companys good reputation a solid loyal customer or client base brand identity and recognition an especially talented workforce and proprietary technology. Where companies amalgamate or are similarly reconstructed it may be necessary to arrive at the value of shares hold by the members of the company being absorbed or taken over.

Goodwill is an intangible asset which is not visible or cannot be touched but can be purchased and traded and is real. Goodwill is the excess of purchase price over the fair market value of a companys identifiable assets and liabilities. Goodwill is a special type of intangible assets that represents that portion of the entire business value that cannot be attributed to other income producing business assets tangible or intangible.

Goodwill represents assets that are not separately identifiable. Generally goodwill may be valued at the time of disposal of business of the firm. Goodwill is a valuable asset if the concern is profitable.

But in many cases the goodwill may be valued to find out value of. In partnership goodwill valuation is very important. Goodwill refers to a measure of the capacity of a business to earn excess profit.

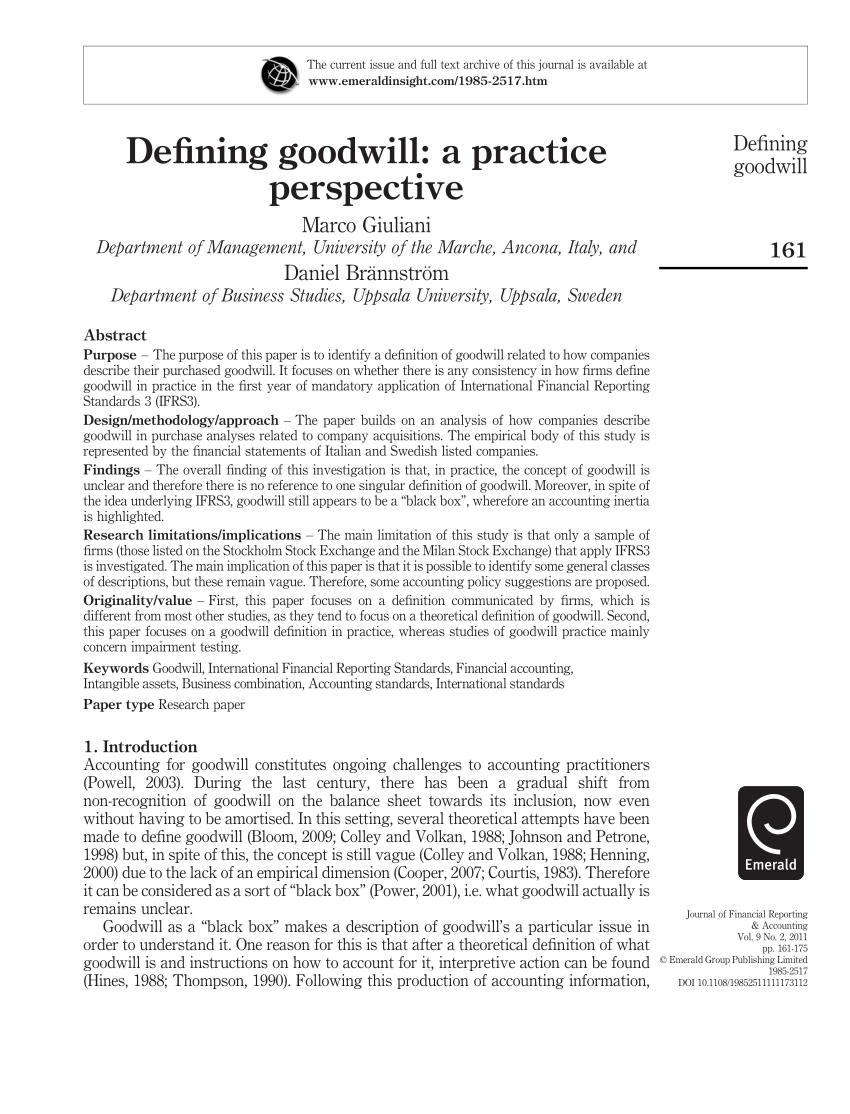

These things are in fact valuable assets of a company. Valuation of goodwill is subjective and is highly dependent on the judgment of the valuer. Types of business goodwill factors giving rise to its creation and leading methods used to measure the value of business goodwill.

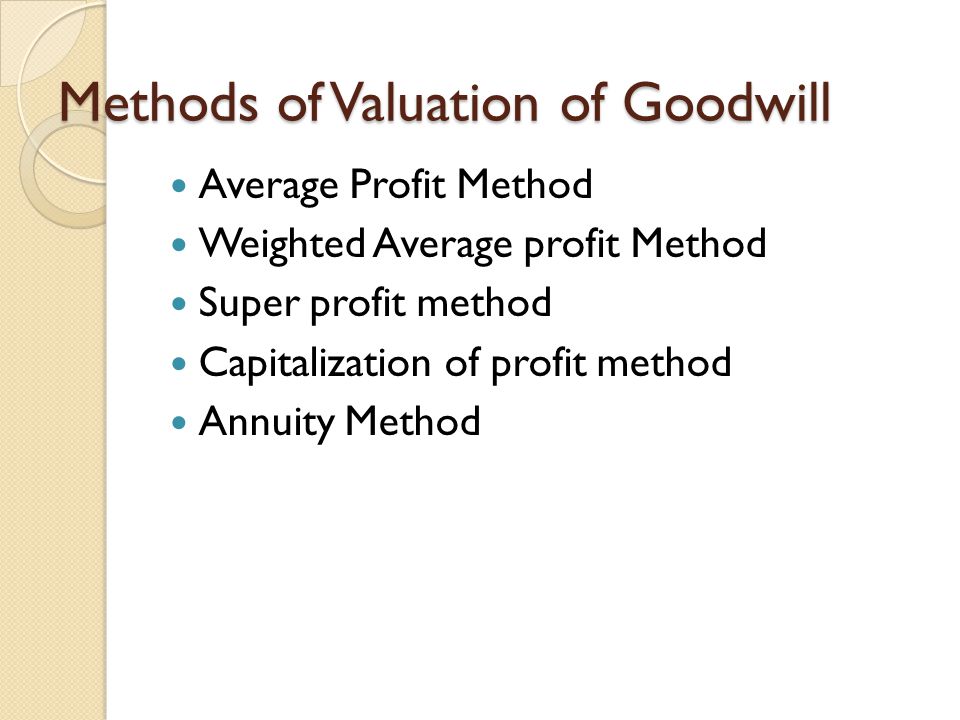

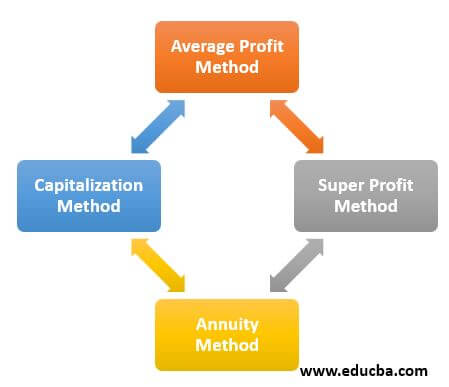

Specifically goodwill is the portion of the purchase price that is higher than the sum of the net. Its tangible effect is extra profit which firms not possessing equal reputation do not earn. Methods of Goodwill Valuation Goodwill is the value of the reputation of a firm built over time with respect to the expected future profits over and above the normal profits.

It is computed on the basis of expected profits in excess of normal profits. Goodwill is an accounting construct that is required under Generally Accepted Accounting Principles GAAP. This asset is known as goodwill and may be defined as the value of the reputation of a firm.

Thus goodwill may also be defined as value of the reputation of business. Methods of Valuation of Goodwill. Goodwill does not include identifiable assets that are capable of being separated or divided from the entity and sold transferred licensed rented or exchanged either individually or together with a related contract identifiable asset or.

Explanation of business goodwill as a key intangible asset measured as that portion of the total business value over and above the identified business asset value.

Valuation Of Goodwill Ppt Download

What Is Goodwill Meaning Definition Types Examples Valuation

Notes On Valuation Of Goodwill And Shares For Bba B Com Students

Goodwill Meaning Valuation Methods Concepts With Solved Examples

Valuation Of Goodwill Ppt Video Online Download

Goodwill Chapter Class Xii Notes

Personal Goodwill And Firm Value Compton Wendler P C

Valuation Of Goodwill And Share

Valuation Of Goodwill Ppt Download

Notes On Valuation Of Goodwill And Shares For Bba B Com Students

Pdf Defining Goodwill A Practice Perspective

Goodwill Valuation Methods Of Goodwill Valuation

A Beginner S Guide To Goodwill Accounting The Blueprint

Goodwill Classes Cat Dog Rat Rabbit Valuation Factors Affecting

What Is Goodwill Definition Features Factors And Need Business Jargons

0 Comments